Risk is the possibility that an event or process or execution does not go as planned. It can also be defined as the uncertainty of undesirable outcomes or effects on objectives.

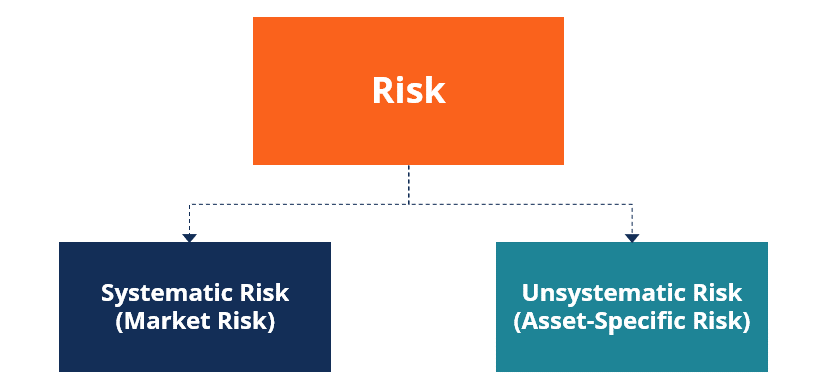

From a broad point of view, there are two major types of risk: Systematic risk & Unsystematic risk.

Systematic risk deals with risk arising from external factors that affect the outcome of a set objective, while Unsystematic risk looks inward to curb asset-specific risk that could lead to undesirable outcomes on set goals

The concept of risk plays an active role with every action or decision a business takes, the possibility that a decision would not pan out as expected is ever looming over the heads of decision-makers. So how do they still go-ahead to make those big decisions with the fear of the unknown and lack of certainty ever-present.

Risk Management is how they do that.

What is Risk Management?

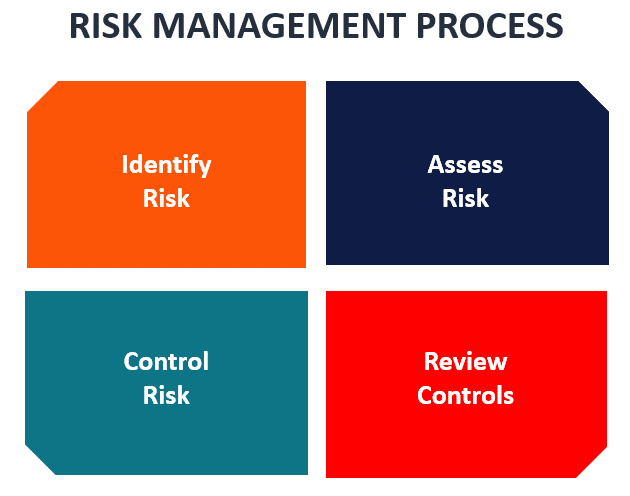

Risk management simply put is taking steps to curb all possible risks present in every objective actualization embarked upon by an organization. Risk management requires the ability to identify the said risk, assess and analyze this risk, then implement measures and controls to mitigate the risks identified, it doesn’t just stop here the implemented controls need to be constantly reviewed and modified if need be. It is key to note that risk management is approached proactively and not reactively.

The proactive approach means preempting the risk and taking the step to mitigate it, while with the reactive it is already too late because the damage has already been done.

An organization’s Response to Risk has a major impact on the outcomes of risk management processes.

Businesses are advised as a best practice to approach the development of risk contingencies with a problem-solving mindset. These contingencies should be well detailed and ready to be executed as soon as the need arises. Having such plans laid down put the business in a pivotal position to respond to risk as soon as identified.

Response to Risks usually takes one of the following forms:

- AVOIDANCE: This involves getting rid of the root cause of said risk in a bid to avoid such risk

- MITIGATION: Setting up of control or effecting already aid down contingencies’ to sufficiently reduce the possible occurrence of the risk

- ACCEPTANCE: In some cases, a business may be forced to accept risk. This option is possible if a business entity develops contingencies to mitigate the impact of the risk, should it occur.

Importance of Risk Management

Risk management is an important procedure because it provides a company with the tools it needs to properly identify and manage potential risks. It is easier to reduce risk once it has been identified. Furthermore, risk management provides businesses with a foundation on which to make informed decisions.

Risk assessment and management are the best ways for a company to plan for events that may obstruct progress and growth. When a company assesses its plan for dealing with potential risks and then implements contingencies to deal with them, it increases its chances of achieving success with business goals and objectives.

Progressive risk management guarantees that high-priority issues are addressed as quickly as possible. Furthermore, management will have the essential knowledge to make informed decisions and ensure that the company remains profitable.

SO, I ASK YOU;

IS THE LACK OF RISK MANAGEMENT INITIATIVES WORTH THE RISK?